Blog Articles

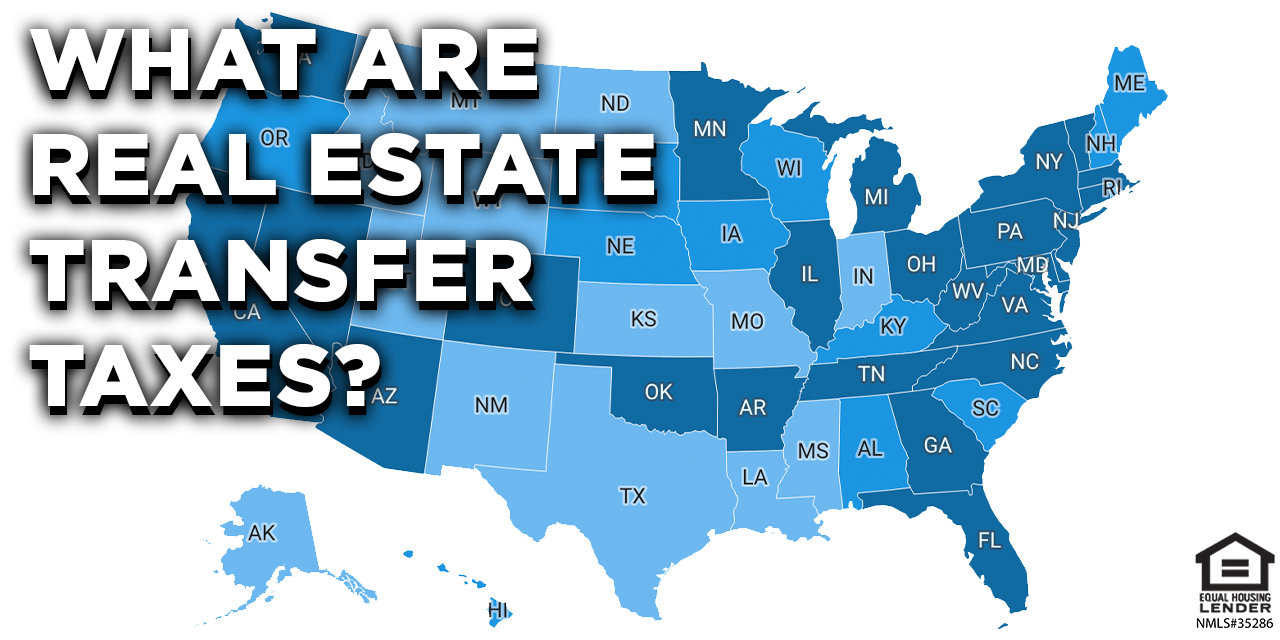

Real Estate Transfer Taxes: What to Consider When Selling Your Home

Posted on

When it comes to selling a home, many homeowners are not aware of their state’s transfer tax,

Read MoreYour Guide to Home Insurance: Strategies for Budgeting and Coverage Planning

Posted on

The average annual cost of U.S. homeowners insurance is $2,511, or over $200 per month, according to Quadrant

Read MoreThe Future of Real Estate Commissions: Strategies for Paying Buyer’s Side Realtor Compensation

Posted on

Prior to the NAR policy changes that are taking place in August 2024, sellers have historically covered

Read More5 Important Steps to Take With Your College-Aged Children

Posted on

Your child’s transition to adulthood is a special and exciting time for your family. This new stage of life, however, often comes with some additional responsibilities. Taking these simple, yet important, steps can help you and your family remain prepared and secure for the upcoming years.

Read MoreITIN Loans: How to Own a Home Without a Social Security Number

Posted on

For borrowers without a social security number, finding suitable loan options can be incredibly difficult.

Read MoreYes, You Can Use Your 401k/IRA to Purchase a Property

Posted on

Purchasing a home is a major milestone, and one of the greatest obstacles to achieving this financial goal is

Read MoreVacation Safety Tips for Your Home

Posted on

A home is broken into every 15 seconds in the United States, with most burglaries occurring between June and

Read MoreCan You Cancel Your PMI Faster if Your Home Value Increases?

Posted on

Home prices increased nationwide by 5.3% from Spring 2023 to Spring 2024, and a staggering 54% since 2019,

Read MoreDebt Detox: How Refinancing Can Rescue You From High-Interest Debt

Posted on

America’s total credit card balance reached a staggering $1.079 trillion in the third quarter of 2023,

Read More3 Reasons to Consider Purchasing a Home for Your College Student

Posted on

Buying a home in a college town requires careful consideration, but it can be a viable strategy to reduce college-related expenses, ensure your student has a safe and comfortable living environment, and potentially earn rental income.

Read MoreImportant Steps to Take When Your Child Turns 18

Posted on

Your child’s 18th birthday is an exciting milestone in their life. Not only is he or she a legal adult

Read MoreWhy Sellers Should Continue Paying Buyers Agent’s Commission in 2024

Posted on

It has long been customary for sellers to cover the commissions for both their own agents and the buyers'

Read MoreWhy 90% of Homebuyers Have Historically Opted To Work With a Real Estate Agent or Broker

Posted on

According to NAR, 90% of homebuyers have historically opted to work with a real estate agent or

Read MoreNJ Lenders Corp. Empowers Buyers With Down Payment Assistance Programs

Posted on

navigate available mortgage assistance programs, determine your eligibility for those programs, and empower you with the knowledge needed to make informed decisions.

Read MoreNJ Lenders Corp. Offers Buyers a Competitive Credit Approval Program with Home Buyer’s Edge

Posted on

The underwriters at NJ Lenders Corp. will meticulously verify your income, assets, and credit, furnishing you with a fully-vetted credit approval, contingent upon an appraisal.

Read More